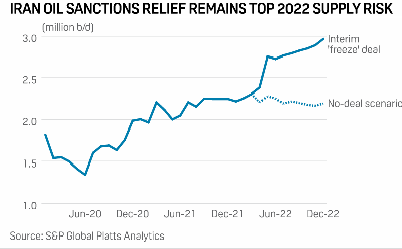

“Rahbord Energy”:The negotiations have been the top oil supply risk for 2022, with an interim deal potentially increasing exports by 700,000 b/d while a breakdown in talks could spike geopolitical tensions” and global oil prices, according to S&P Global Platts Analytics.

Paul Sheldon, Platts Analytics senior geopolitical adviser, said Feb. 6 that the talks could easily continue for months.

“The US continues to voice urgency and the need for a diplomatic solution within weeks, but we suspect far more patience exists than suggested by public comments,” he said.

The State Department notified Congress Feb. 4 that it was restoring a sanctions waiver to allow third-party participation in nuclear non-proliferation and safety projects, in particular with respect to rising stockpiles of enriched uranium in Iran, a senior State official said on the condition of anonymity.

Some analysts initially saw the waiver as a sign that a deal was imminent, but the State official refuted those takes.

“To be clear: this is not a concession to Iran,” he said. “The nuclear non-proliferation and safety projects enabled by this waiver are in our vital national interest as well as the interest of the region and the world — and will continue to be regardless of the outcome of talks in Vienna.”

‘Inching ahead’

Henry Rome, Eurasia Group’s deputy head of research, said the “waivers are less a goodwill gesture or a concession to Iran, but rather technical steps that are probably aimed at ensuring implementation discussions can go forward in Vienna.”

“It’s a modest sign of movement,” Rome said Feb. 4. “The waivers may have been needed to do more advanced preparation on issues of implementation, such as regarding potentially exporting excess enriched uranium to Russia. It’s not dispositive of a deal or not, but it shows the negotiations are inching ahead.”

The Joint Comprehensive Plan of Action of 2015 set restrictions on Iran’s nuclear program in exchange for relief from US sanctions. The Trump administration reimposed sanctions on Iran’s oil, petrochemicals, shipping and other sectors in 2018.

Talks to revive the JCPOA stalled in mid-2021 but restarted in December.

Price pressures

Iranian Oil Minister Javad Owji on Feb. 2 indirectly called on the US to drop its sanctions to balance the oil market, where prices have raced past $90/b in recent days.

“If the global consumers, especially the big economies, are unhappy with the current price levels and supply volume, and find them against their interests, my best suggestion for them is cancelation of the US unilateral sanctions as quickly as possible, and opening the room for return of Iran’s production with maximum capacity to the global markets,” Owji said.

“Undoubtedly, the global market needs the additional Iran’s supply. We are ready to increase our oil supply to the global markets as soon as possible.”

The S&P Global Platts OPEC survey estimated Iran produced 2.5 million b/d in November and December 2021. The US Energy Information Administration estimated Iranian production at 2.45 million b/d in November and December.

Iran’s output averaged 3.79 million b/d in 2017, according to the Platts survey.