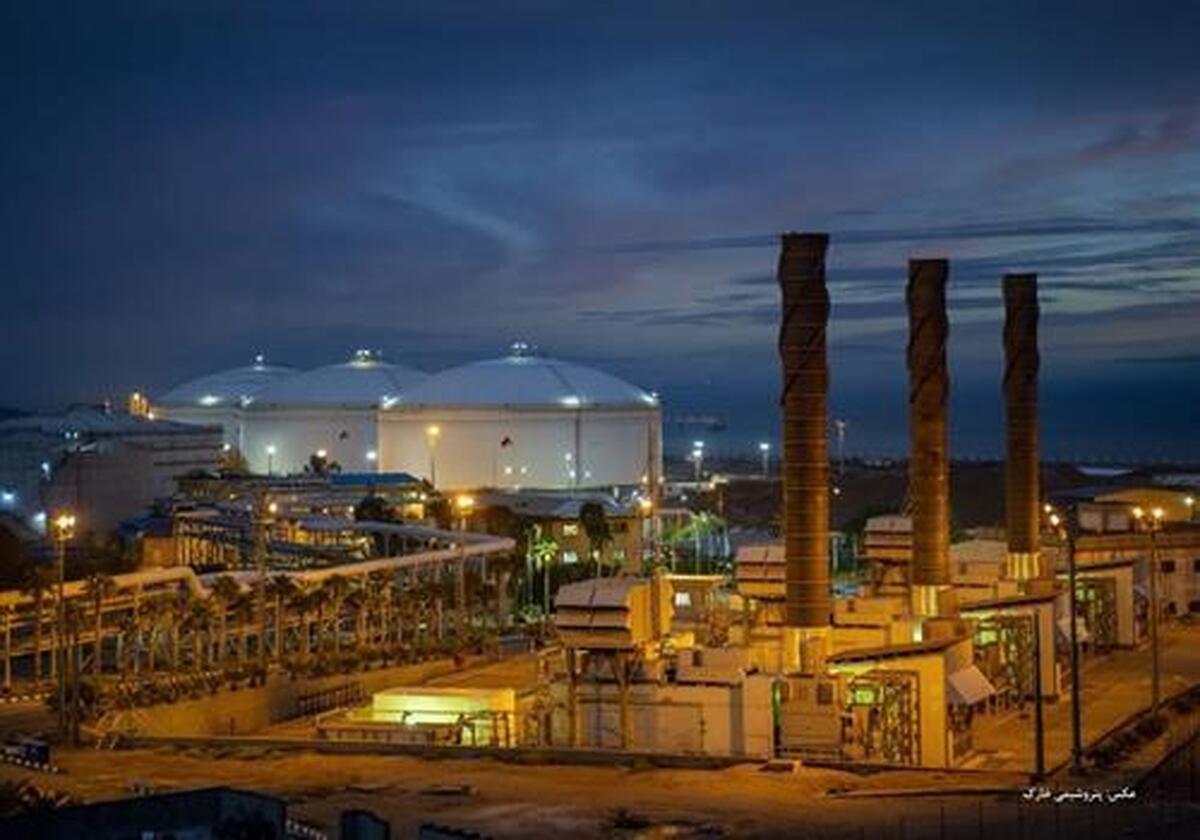

Kharg Petrochemical Company has published its financial performance report through the end of Azar 1404 (December 2025). A review of the figures shows the company is on a steady growth path for operating revenue. In the nine months of the current year (April-December 2025) the company achieved revenues of 15.2 trillion rials — the highest level of revenue in the past five years and a meaningful 35% increase versus the same period last year.

Achieving 15-trillion-rial sales from April to Decembre 2025

Kharg’s petrochemical total sales from April to Decembre 2025 reached approximately 15 trillion rials. By comparison, sales in the same period last year were about 11 trillion rials, meaning operating revenue grew 35% year over year.

December A productive month with 2.8-trillion-rial sales

In December the company’s production volume reached about 90,000 tons, 13% higher than the same month last year, 13% above this year’s average production, and 4% above last year’s average — indicating stable and continuously improving production performance.

In the sales sector, the company’s performance exceeded expectations. Kharg Petrochemical sold 152,000 tons of product, which is 153% higher than the previous month and 167% higher than December of last year. This is notable given that the company’s monthly sales in prior months typically ranged between 50,000 and 80,000 tons, and December marked an unprecedented operational turning point with a jump in volume. December 2025 sales also surpassed all historical averages, recording increases in sales volume of 87% versus 2025, 74% versus 2024, 62% versus 2023, and 66% versus 2022.

The peak of this impressive performance was reflected in revenue, where the company achieved about 2.8 trillion tomans in December. This striking figure is 138% higher than the 1.1-trillion toman revenue of the previous month and 316% higher than December of last year, making December 2025 one of the company’s most historic revenue months. It is also 64% above this year’s average revenue and 98% above last year’s average. Of that total, 1,858 billion tomans—equivalent to 67% of monthly sales—came from methanol export, underscoring once again the key role this product plays in the company’s revenue mix.

An analysis of the company’s revenue mix shows that a total of 8,845 billion tomans of Kharg’s nine-month revenue came from the production and sale of methanol. This highlights the company’s high revenue dependence on methanol and the importance of the product’s price and volume trends for Kharg’s Petrochemical profitability. This exceptional performance is the result of intelligent inventory management, precise timing of sales at higher exchange rates, and securing production with cheaper dollars — all of which reflect an accurate assessment of market conditions and effective decision-making by the management team of Kharg Petrochemical.

The selling price of methanol has also trended upward this year. The average selling price of methanol from April to Decembre 2025 was about 173 million rials per ton, a 45% increase compared with the same period last year. This price rise, together with relatively stable sales volumes, has played an important role in improving the company’s operating revenue. Overall, Kharg Petrochemical’s performance report in these nine-month shows significant growth in operating revenue, strong performance in December, and a meaningful increase in methanol selling prices — factors that could paint a more positive outlook for Kharg’s financial position and profitability for the remainder of this fiscal year.

December 2025 can be considered a turning point in the operational and financial performance of Kharg Petrochemical: a month that has set a new standard of productivity, sales, and profitability for the company.

The sum of these data shows that Kharg Petrochemical has entered a new phase of sustainability and growth not only in terms of revenue but also in production and sales—a phase that, if sales management continues and operational stability is maintained, can outline the company’s profitability outlook in the coming months more clearly than before.